July Tax Changes: What You Need to Know

The 2024 New Zealand Budget focused on spending cuts and tax relief for middle-and-lower income working families. Amid concerns about the cost of living and job security, these measures aim to boost disposable income leading to more consumer spending.

As a result, the Inland Revenue introduced a few tax changes this July.

Income Tax

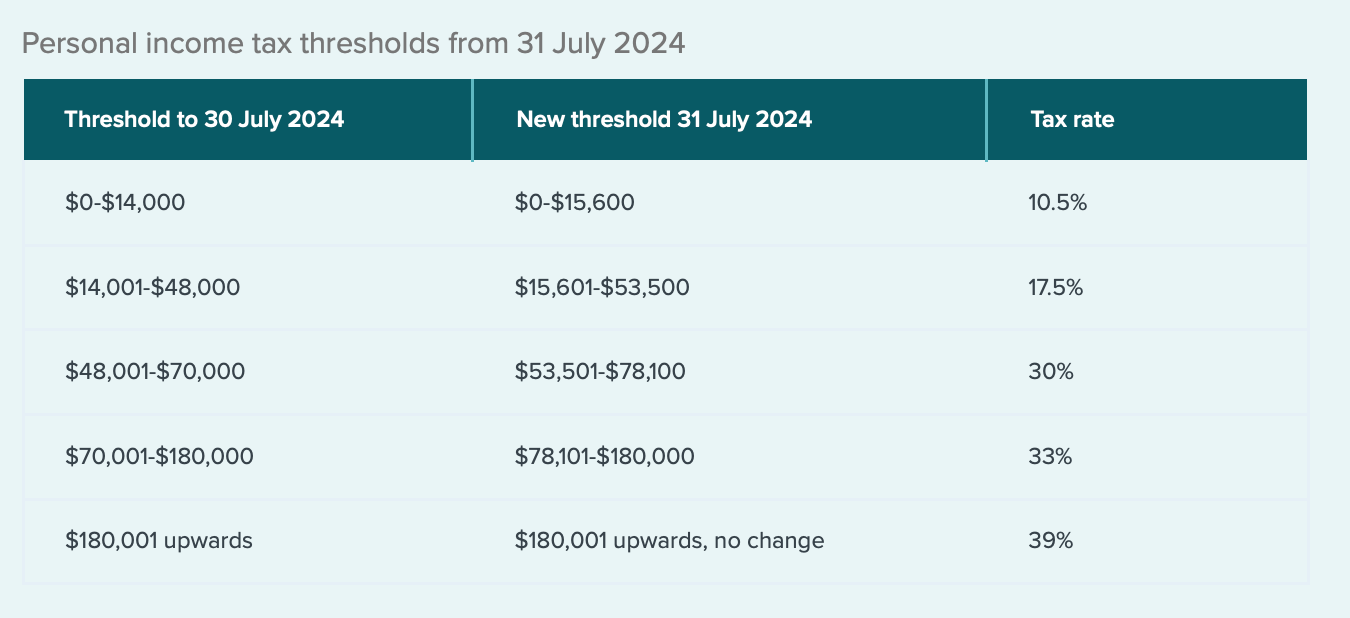

Changes to the income tax thresholds took effect on July 31. These changes aim to increase personal income, extend the independent earner tax credit, and increase the in-work and family tax credit.

Personal Income Tax Thresholds

Independent Earner Tax Credit

In the 2024 budget, the Government stated, “Increasing PIT [personal income thresholds] thresholds reduces income tax for people receiving over $14,000 of income per annum. The current thresholds have been the same since 2010… As wages have grown over time, people have paid more of their incomes in tax. Increasing the income tax thresholds goes some way towards addressing this.”

Brightline Rule

July 1 saw the introduction of a new Brightline Rule for residential properties.

The Bright-line Test applies to any residential property where if it is sold within a set period (the bright-line period) any profit will be taxable.

Under the previous government, this was 5 - 10 years. However, as of July 1, this has been reduced to 2 years.

This also applies to residential properties purchased and sold overseas by a New Zealand tax resident.

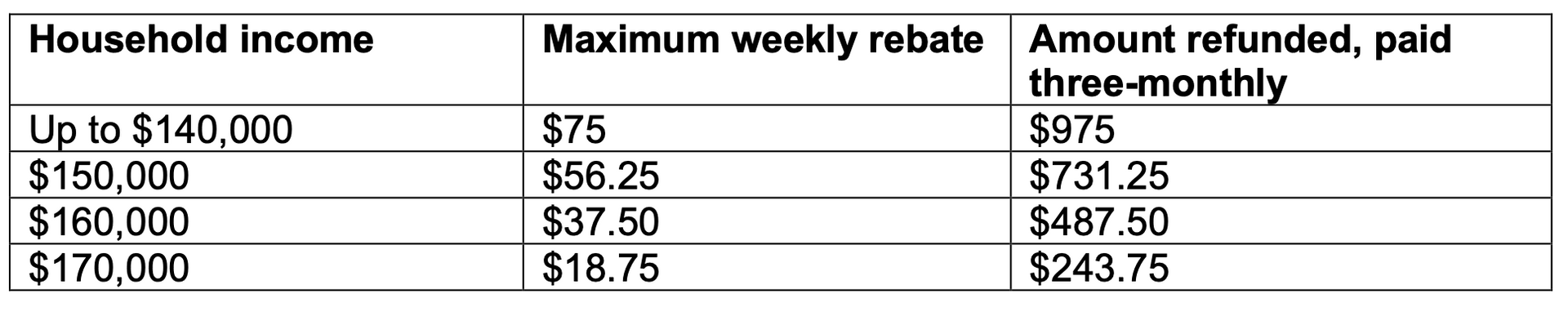

FamilyBoost

FamilyBoost is a new childcare payment made available to help with the rising cost of early childhood education. Households can be reimbursed up to $75 per week after 20 Hours Free and MSD Childcare Subsidy has come out, meaning eligible families could receive a boost of $975 every three months.

You could be eligible if you incur a cost from a licensed ECE provider and your household earns under $180,000 p.a. The table below shows the maximum weekly rebate based on income.

KiwiSaver

KiwiSaver contributions are optional for parents receiving paid parental leave. However, from July 1 if you choose to have KiwiSaver deducted from your parental leave entitlements, the IRD will also make an employer contribution of 3%.

If you still receive an income from your employer while on paid parental leave, they will continue to make KiwiSaver deductions from your income and compulsory employer contributions.

Paid Parental Leave

From 1 July parental rates have increased.

Eligible employees and self-employed parents will see their maximum weekly rate rise from $712.17 to $754.87 gross.

For self-employed parents, the minimum parental leave payment will increase from $227 to $231.50 gross per week, reflecting the minimum wage increase effective from April 1.

For personalised advice on navigating these changes and optimising your tax situation, contact us. Our team is here to help.