How will a National-led Government affect you?

As news headlines announce that NZ First’s, Winston Peter’s is heading to Wellington for coalition talks, we still don’t know yet how the new National-led government will be formed. But we do know that National has pledged to make some major changes to tax. They’re calling it the ‘Back Pocket Boost’ with a focus on helping “the middle” get ahead. Here’s how some of the changes could affect you.

Tax relief for the middle

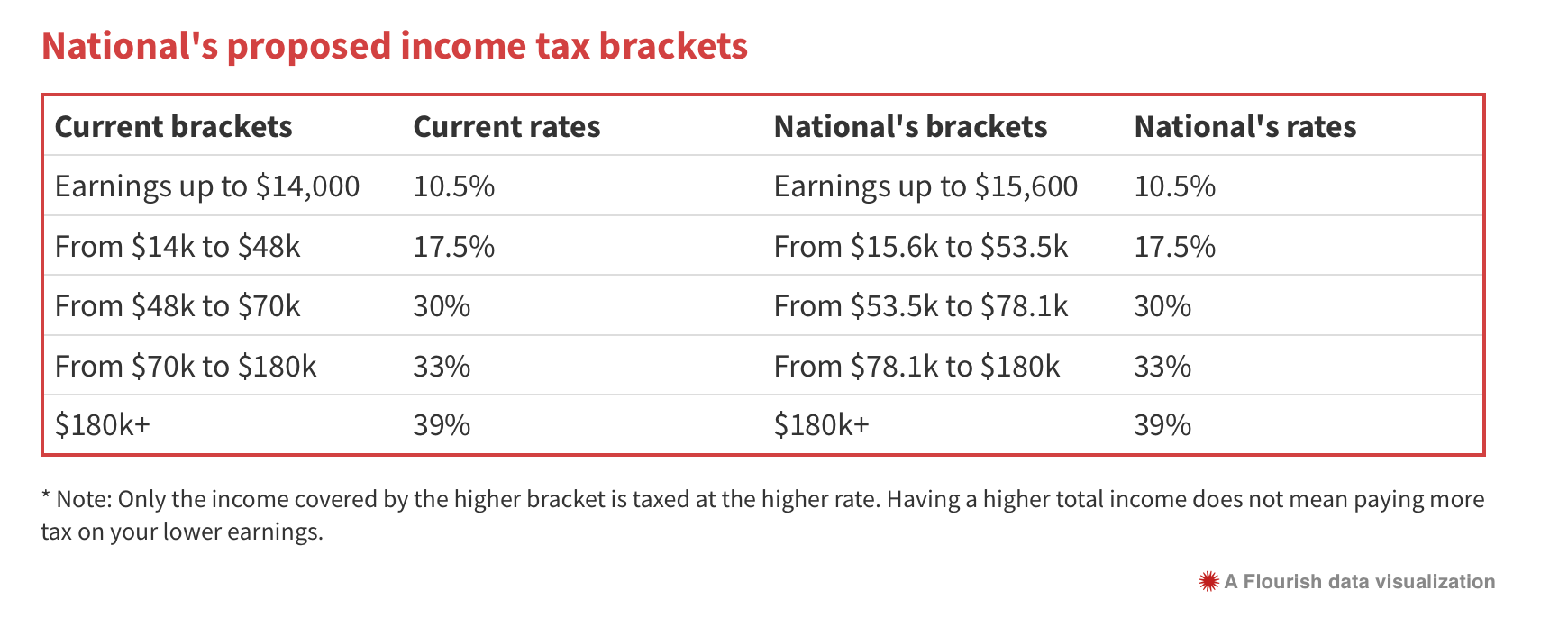

National’s plan includes several tax cuts, which aim to boost New Zealander’s after-tax income. The Back Pocket Boost tax-relief plan effectively increases the after-tax pay you take home, by adjusting income-tax brackets to compensate for inflation. This diagram featured on

RNZ shows National’s income tax bracket adjustments.

Several key elements of the National Government’s economic plan include:

- As NZ Superannuation payments are linked to average after-tax wages, NZ Super is expected to increase by $680 a year, or $26 per fortnight.

- The Independent Earner Tax Credit will be extended. At present, it gives people earning between $24,000 and $48,000 a year an extra $10 per week as a tax credit.

- National plan to cancel fuel tax hikes, which could eventually save 12 cents per litre of petrol.

- National’s Back Pocket Boost indicates it will increase tax credits for Working for Families, with the in-work tax credit increasing from $72.50 to $97.50 a week.

- National is planning to scrap the 20 hours of free ECE for two-year-olds and will replace this with a Family Boost Tax Credit. This is said to provide families with a childcare tax rebate of up to $75 per week on the cost of childcare, which reduces for higher incomes.

- National will scrap the clean car rebate at the end of 2023. Instead, they plan to redirect all future Emissions Trading Scheme revenues to tax cuts, saying they would fund climate policy from the general Budget allowance.

Brightline test

National plans to roll back the bright-line test to 2 years. The bright-line test is a rule that dictates when a property is sold if it will be subject to a capital gains tax. At present, the bright-line test currently sits at 10 years for most properties. It is not clear just yet when this would take place.

Interest deductibility on properties

At present, if you purchased a property after March 27, 2021, you can’t claim any interest on your property when calculating your tax. However, National have said they will gradually reinstate the 100% interest deductibility. This will happen in increments over the next three years.

ACT and NZ First have their own policies on tax, so this will likely mean further negotiations on tax changes.

It is important for you to stay informed about the issues, and how these changes made by the government can affect your financial situation. Here’s some tips:

- Review your financial situation. This will help you understand how any changes to the tax policy might affect you or your business.

- Talk to your accountant. We can provide you with advice to help minimise the impact of these changes.

- Stay informed. There are a range of resources available to help you stay informed about the potential impact of these changes on you or your business.

Need financial advice? Get in touch.